Explore our blogs...

Jan 14, 2025

We’re thrilled to start off 2025 on a high note by announcing the close of our $11M Series A. We’re grateful to all of the investors, customers, partners, and team members who helped us get here, especially Deciens Capital, which led the round with participation from Pipeline Capital Partners and Runa Capital. These firms, and many investors and supporters, have been along for the ride for several years now. We’re lucky to be building Sydecar with their continued support.

Sydecar was founded in 2021 based on the idea that it should be simple and efficient to form and manage private investments. Since then, we have established ourselves as the leading SPV and fund administration platform for emerging venture capitalists. We have earned the trust of over 1,200 SPV and fund managers, and tens of thousands of individual investors, family offices, and institutions who have invested over $1.6B through our platform. Over the past four years, we’ve closed more than 2,500 investment vehicles, providing our customers and their LPs with a seamless investment experience and saving our customers countless hours of operational and administrative work. We have built our suite of products to help venture investors execute and manage all types of investments, including SPVs, committed capital funds, syndicates, co-investments, secondary transactions, and more.

Our Series A is an important milestone for Sydecar, as it reflects our progress and the belief of institutional investors in our team and mission – but our work continues. We are more committed than ever to our amazing customers and will use this funding to continue to deliver the best-in-class product and customer experience that the industry has come to know us for.

The path ahead is clear. We will continue to deliver what our customers want most from us: trustworthy, reliable, and robust transaction support in a cost-efficient manner. This year, we will expand our product suite to support more complex transactions and continue to improve our experience for deal leads and their investors. We will also double down on community and look for opportunities to connect with our customers, our partners, and others across the venture capital and private market ecosystem. Looking ahead, we will bring the benefits of our infrastructure beyond venture to other areas of the private markets.

We can only do this with the help of a world-class team, which we’ll expand in the months ahead. We are always looking for passionate, humble individuals who take pride in their work, set ambitious goals, and enjoy winning together. If this sounds like you, please take a moment to review the open positions on our Careers page.

Our Series A brings our total funding raised to over $26M, leaving us well-equipped to build the infrastructure that powers private markets. With our platform, you can simplify your deal execution and focus on what matters most—building your portfolio, track record, and relationships. If you’re interested in seeing how Sydecar can transform your operations, get in touch today.

Read More

Oct 24, 2024

With Q3 officially in the books, Sydecar is proud to announce significant enhancements across our platform, from refining compliance processes to launching our innovative Syndicate platform. These updates reflect our ongoing commitment to innovation and our dedication to meeting the evolving needs of fund managers, syndicate leads, and investors. Read on to discover how these new features can transform your investment management experience with Sydecar.

Compliance

Improving UBO Workflows

What It Is: We've made it easier to manage information about Ultimate Beneficial Owners (UBOs) during the setup of entity profiles on Sydecar. Key updates include:

Allowing a designated person to input UBO details without replacing existing UBO profiles, even when using the same email address, provided they have permission from the UBOs.

Providing the ability for designated individuals to update or delete UBO information directly within the entity profile, with the necessary approvals from the UBOs involved.

Why It's Important: These improvements streamline the setup process for entity profiles with UBOs, reducing the time and effort required to comply with legal requirements. With these changes, managing and updating UBO information is more straightforward for entities with complex ownership structures.

Corporate Transparency Act Update

What It Is: Sydecar has enhanced its SPV and Fund+ products in response to the Corporate Transparency Act (CTA). This update allows organizers to opt in or out of partnering with Sydecar for CTA compliance and includes provisions for collecting information from individual users for Beneficial Owner Information (BOI) reporting.

Why It's Important: This update streamlines the collection of ownership information, enabling fund managers and investors to meet reporting requirements quickly and with less administrative effort.

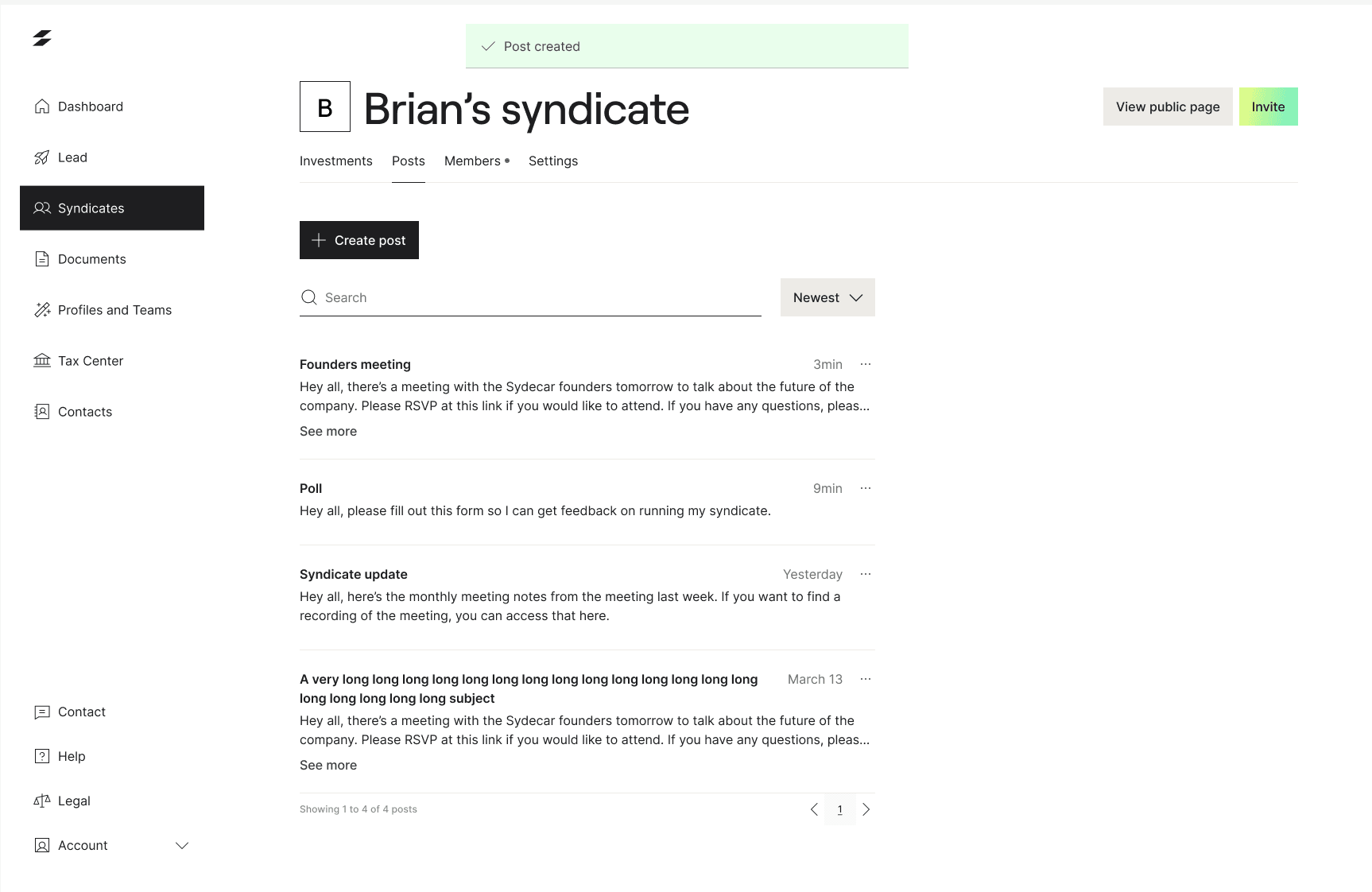

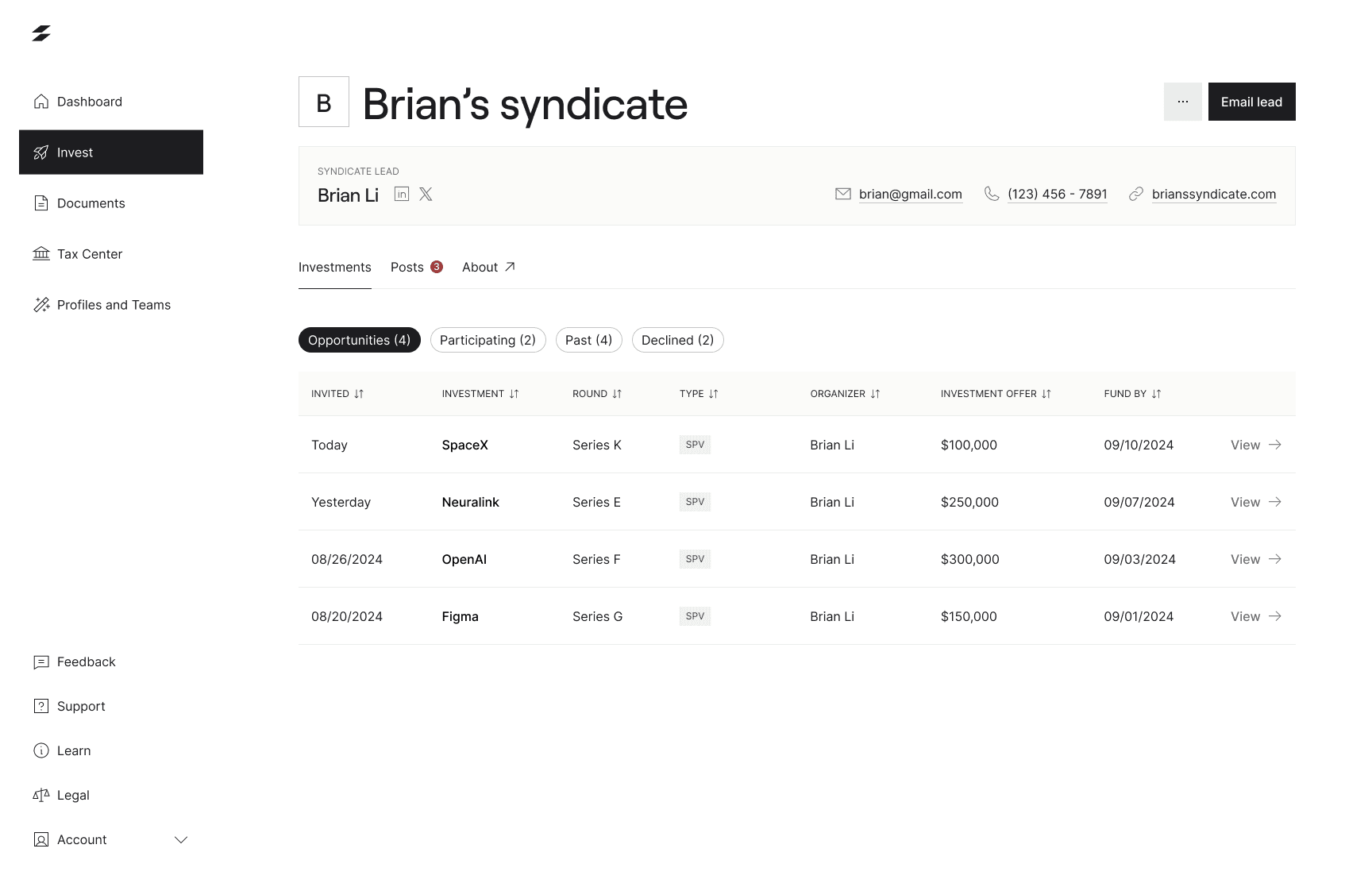

Syndicate

Syndicate Platform Launch

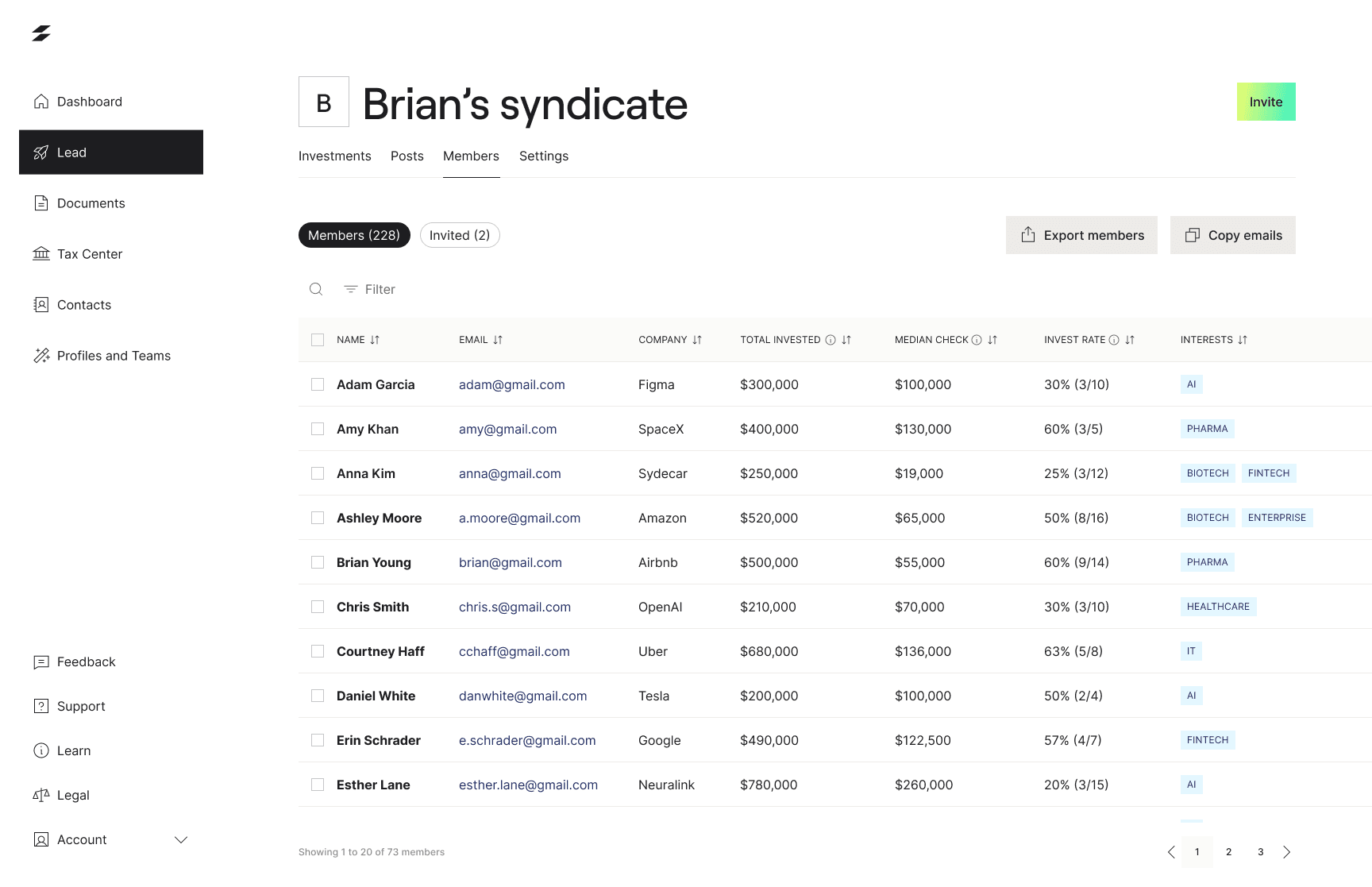

What It Is: Sydecar's new Syndicate platform offers robust tools to enhance the operations and effectiveness of syndicate leads:

Centralized Communication: Enables direct communication with all members through the platform, allowing updates on syndicate activities, deal flow, and successes to be shared efficiently to keep everyone informed and engaged.

Member Portal: Provides investors with a dedicated portal where they can view deal flow and communicate directly with the syndicate lead, ensuring their information remains confidential and under the control of the syndicate lead.

Deal Tracking: Leverages analytics to monitor member participation and engagement, allowing syndicate leads to focus on investors who are most active and likely to participate in future opportunities.

Why It's Important: Sydecar’s new syndicate platform addresses the specific needs of syndicate leads who have historically had to manage their activities across multiple, disjointed tools. By centralizing these functions, the platform not only saves time but also reduces the likelihood of errors, enhances communication, and improves decision-making processes. This new product simplifies complexities, ensuring that they can focus more on strategy and less on administrative tasks.

As we continue to enhance our platform, we remain focused on providing the most robust and compliant solutions in the market. These latest updates are designed to meet the specific needs of our clients, ensuring they can manage their syndicates, SPVs, and funds with greater ease and security. We thank our dedicated community of venture managers for their feedback, which has directly informed these updates. Stay tuned for further developments as we continue advancing our platform to support your venture operations effectively.

Read More

Oct 10, 2024

MA7, the new syndicate co-led by Murat Abdrakhmanov and Yelzhan Kushekbayev, is making waves in Kazakhstan’s venture capital ecosystem. While Murat is recognized as the country's most prominent angel investor, Yelzhan brings extensive experience, having personally invested in 90 SPVs since 2020. Together, they’ve launched the MA7 Angels Club, a syndicate leveraging Murat’s deal flow to give individual investors exposure to high-growth opportunities.

The Birth of MA7

Yelzhan and Murat met through Astana Hub, a government institute that supports the growth of Kazakhstan’s tech and IT ecosystem. Murat, a mentor in the Hub’s first angel investor cohort, saw potential in Yelzhan and invited him to partner in creating MA7. With Murat’s track record of a combined portfolio that includes over 50 companies and 12 exits, the duo set out to develop a syndicate in Kazakhstan that emphasizes meaningful, transparent interactions with investors.

Investment Strategy and Notable Deals

MA7 focuses on sectors they understand and have deep expertise in—primarily B2B SaaS, fintech, edtech, hrtech, deeptech, and AI. Avoiding industries like biotech or agriculture tech, they instead invest in promising startups like Hero’s Journey, a Kazakhstan-originated, US-based fitness company. Hero’s Journey has created a revolutionary gamified gym experience that uses (automation and IoT) to optimize customer engagement and revenue per square meter. MA7 raised $1mil in a $6 million seed round to support Hero’s Journey’s expansion into New York.

Another recent investment is Zibra AI, a platform that transforms text into 3D objects for game development. Murat had already invested personally in the company before Andreessen Horowitz backed it. When the next round came up, Murat and Yelzhan brought in their MA7 syndicate members, giving them a chance to back a leader in AI-driven game design. The syndicate members quickly jumped at the opportunity to participate in the round.

One unique aspect of MA7’s strategy is the commitment Murat and Yelzhan have made to each deal. While many syndicate organizers often contribute as little as 10% or less of the allocation, MA7 aims to put 30-50% of their own capital into each investment. This higher level of personal investment ensures alignment with their investors and strengthens the trust within their community.

Why Sydecar?

From the outset, MA7 chose Sydecar to manage their syndicate operations because of the platform’s flexibility and user-friendly interface. Yelzhan also emphasized the importance of Sydecar’s due diligence and KYC process. Kazakhstan’s geographical proximity to Russia adds complexity for investors, and Sydecar’s team has been diligent in ensuring compliance while also accommodating the specific needs of MA7’s investor base.

Building a Community

One of the standout features of MA7’s syndicate is its tight-knit investor base. With 80+ investors, all of whom are friends or direct referrals, MA7 is committed to building meaningful relationships. Deal presentations take place where founders pitch directly to the syndicate’s investors, followed by detailed analysis sessions with the investors where Yelzhan and Murat break down the investment thesis, risks, and benefits. This approach fosters transparency and trust, ensuring their investors understand the full scope of each opportunity and feel confident in their investments.

MA7 also occasionally hosts offline gatherings, including venture-focused regattas and apres ski events across the globe. These events combine networking with educational sessions on venture capital, further strengthening the community.

The Road Ahead

In the coming year, MA7 aims to invest $10 million across 15 deals and grow their investor base to 300. While they’ve grown their syndicate through word-of-mouth, they’re now planning to launch a public website and engage in more formal marketing activities.

With the support of Sydecar’s platform, Murat and Yelzhan are well-positioned to scale their operations, expand their investor base, and continue sourcing top-tier deals from Kazakhstan, central Eurasia, and beyond. Sydecar streamlines everything from investor management to deal tracking and communications, helping syndicates like MA7 operate with precision and efficiency. Learn more about how Sydecar’s Syndicate platform can enhance your syndicate operations by visiting our Syndicate page.

Read More

Sep 5, 2024

Today, we’re thrilled to introduce a new tool that will transform the way syndicate leads manage deals and engage investors. Sydecar’s Syndicate platform is designed to empower syndicate leads and their investors by combining all essential tools into a single, intuitive platform. This platform simplifies member communications, tracks deal participation, and supports syndicate growth—all in one place.

Managing a syndicate has historically been cumbersome and time-consuming. Syndicate leads have had to rely on a patchwork of tools to manage their operations. This fragmented approach not only wastes time but also increases the risk of miscommunication and missed opportunities.

Sydecar’s Syndicate platform offers a unified solution: a platform where all syndicate activities are centralized, making it easier than ever to keep your members informed, engaged, and ready to act. Our platform ensures that you can focus on what matters most—sourcing deals and building relationships—while we handle the rest.

Key Features

Centralized Communication: Say goodbye to juggling multiple communication channels. With Sydecar, you can streamline all member communications directly within the platform. Effortlessly share updates on syndicate activities, deal flow, and past successes, ensuring everyone stays informed and engaged.

Member Portal: Maintain full ownership and control of your contacts. Investors have a dedicated portal where they can view deal flow and communicate directly with you. Best of all, their information remains between them and you, private from other syndicate leads.

Deal Tracking: Get insights into member participation. With our analytics tools, you can easily identify and target engaged LPs for future opportunities, optimizing your syndicate’s success.

We developed the Syndicate platform with the unique needs of syndicate leads in mind. Our goal is to eliminate the inefficiencies that have long plagued syndicate operations and to provide a seamless experience that scales with your growth.

We’re excited to continue supporting the next generation of syndicate leads and venture investors who are looking for more efficient, transparent, and scalable solutions. With the launch of our Syndicate platform, we’re taking another step toward transforming the way private markets operate, and we’re excited to have you with us on this journey.

Experience the impact of our Syndicate platform firsthand. Visit our website to explore an interactive demo that will show you firsthand how our platform can streamline your syndicate operations and help you achieve more with less effort.

Read More

Sep 5, 2024

Gabriel Jarrosson, a seasoned venture capitalist and founder of one of the largest French angel syndicates, has been navigating the complexities of syndicate management since 2017. With over 750 active angel investors and a community of over forty thousand on social media, Gabriel has built a significant presence in both France and Silicon Valley. His syndicate, Leonis.vc, invests primarily in YC companies. He is also the Managing Partner of a fund, Lobster Capital.

In the early days of his syndicate, Gabriel struggled with the inefficiencies of managing French SPVs, describing the experience as nothing short of “horrible.” Seeking a better solution, he transitioned to using Assure’s Glassboard product for his syndicates. However, when Assure shut down, Gabriel needed a reliable alternative. Two years ago, he discovered Sydecar.

Unified Communication and Operations

Running a large syndicate requires efficient communication and operational tools. Sydecar’s Syndicate platform provides Gabriel with the capability to manage all investor communications, from creating posts and sending updates to handling investment memos—all directly within the platform. The platform’s design offers the control and customization needed to engage investors more effectively.

Keeping LP Information Private

Gabriel’s primary motivation for choosing Sydecar as his syndicate platform was the platform's commitment to privacy and control. Unlike other platforms, where LPs might receive deal offers from multiple syndicate leads, Sydecar ensures that Gabriel's investors see only his deals.

Moving Forward

Looking to the future, Gabriel sees Sydecar as more than just a tool—it’s a platform that evolves with his needs. As he prepares for his next fund, Sydecar’s continued innovation ensures that Gabriel can stay ahead of the curve and keep his investors engaged.

Gabriel’s success with Sydecar showcases the power of an all-in-one platform to transform syndicate management. If you’re interested in seeing how Sydecar can streamline your syndicate operations, check out our interactive demo. The demo offers a step-by-step guide on how easy it is to set up a syndicate on our platform.

Read More

Aug 30, 2024

Michele Schueli, GP at ARMYN Capital, stands out in the venture capital space for his strategic focus on secondary transactions. With a keen eye for identifying market dislocations, Michele has successfully navigated the turbulence of recent years, turning undervalued assets into profitable opportunities. His approach to secondary investments reflects a blend of opportunism, market insight, and a deep understanding of the evolving needs of LPs.

Opportunity in Market Dislocations

Michele's interest in secondary transactions began in 2019 and persisted even through the market turbulence of 2022 and 2023. In fact, as valuations of high-quality companies fluctuated dramatically, Michele identified opportunities where solid companies were trading at significant discounts.

Michele's strategy at ARMYN Capital also includes facilitating liquidity for LPs through carefully timed transactions. By helping LPs find buyers when the right opportunity arises, Michele ensures that his LPs can capitalize on market conditions without being locked into long-term positions. Michele highlighted that some of the most coveted names in the market are only accessible through secondary transactions.

Evaluating Secondary Deals

When assessing secondary deals, Michele breaks them down into two categories: highly sought-after tender offers in companies such as Stripe, and companies that are temporarily mispriced due to market conditions due to individual sellers seeking liquidity. For the high-demand names, the focus is on securing access. However, for mispriced opportunities, ARMYN relies heavily on financial data and their knowledge of the company.

Michele also emphasizes the importance of understanding the preference stack when dealing with secondary transactions; it's crucial to know where that stock sits in the stack. This can significantly impact the investment's risk and return profile.

Sydecar’s Role in Secondary Transactions

Sydecar’s platform has been a game-changer for ARMYN Capital when it comes to handling secondary transactions. One feature that stands out is Sydecar’s easy-to-use pooling system, which makes gathering and managing funds from multiple investors a breeze. This has saved Michele a lot of time and allowed him to focus on finding the right deals instead of worrying about the logistics.

With Sydecar, Michele has been able to scale ARMYN Capital’s secondary strategy, making the process faster and more reliable. The platform’s efficiency has become a key part of ARMYN’s success, helping Michele stay competitive in a fast-moving market.

Looking Ahead

As the venture capital market continues to evolve, Michele believes that secondary transactions will remain a vital part of ARMYN’s investment strategy, particularly in the absence of a robust IPO market.

Michele anticipates that the trend of secondary transactions will persist, driven by the need for liquidity and the maturation of private companies that might have otherwise gone public in different market conditions. He believes that the role of secondaries is only going to grow, especially as more companies embrace tender offers as a viable alternative to IPOs.

If you're inspired by Michele’s approach, check out how you can streamline your own secondary transactions with our interactive product demo. With our interactive demo, you’ll get a step-by-step walkthrough of how to create a deal on our platform. Whether you're a seasoned manager or new to secondary deals, this demo will show you how easy Sydecar makes the process.

Read More

Jul 2, 2024

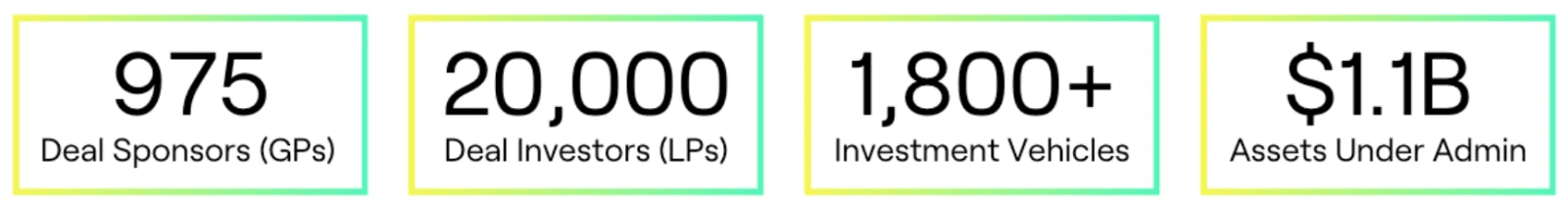

We're excited to share that Sydecar has surpassed $1 billion in assets under administration (AUA). Here's a snapshot of how we’re doing currently:

As we celebrate surpassing this mark, we're not just signaling a financial milestone; we're showcasing a shift towards a more standardized, transparent, and efficient approach to private investing. This achievement underscores our platform's credibility and the trust the market places in our mission to streamline venture fund and SPV management.

Reaching $1 billion in administering assets reflects the growing confidence that fund managers and investors place in Sydecar. It's a testament to our platform's ability to manage deal execution seamlessly. Our journey from reaching $350 million in AUA just two years ago to now administering over $1 billion illustrates our capability to scale and adapt to the evolving needs of the venture capital ecosystem.

Embracing Standardization in Private Investing

This milestone is significant not just for Sydecar but for the entire venture ecosystem. It signals a shift towards embracing a standardized approach to structuring and managing investment vehicles. Standardization brings numerous benefits, including reduced complexities, lower costs, and improved accessibility for new entrants in the venture capital space. By pioneering a product-driven approach, Sydecar has established an industry standard to simplify the investment process, making it more transparent and accessible.

Advancing Our Mission for a More Transparent and Efficient Market

Achieving $1 billion in assets under administration brings us closer to realizing our mission of enhancing transparency, efficiency, and liquidity in private markets. This milestone demonstrates our capability to provide clear and accessible processes, streamline complex operations, and facilitate quicker transactions, increasing market liquidity.

A Look Back: The Road to $1 Billion

Sydecar was born out of a necessity to solve the inefficiencies and high barriers to entry in private investing. Our founders experienced first-hand the challenges of setting up and managing investment vehicles. This understanding drove our commitment to creating a platform that not only meets the compliance and operational needs of today's investors but also anticipates the demands of tomorrow's market dynamics.

Our SPV product was just the beginning. Today, Sydecar supports a wide array of investment activities with tools that ensure compliance, streamline operations, and enhance investor communication. These tools have been crucial in achieving the milestone we celebrate today.

Looking Forward

As we continue to grow, our focus remains on expanding our platform to support the next wave of innovations in venture investing. The introduction of new products designed to remove regulatory barriers and enhance capital formation is on the horizon. We are excited about the future and committed to supporting our clients in unlocking more opportunities in private markets.

We are incredibly grateful to our clients, partners, and the entire Sydecar team for being part of this journey. Here's to continuing our mission of transforming private market investing together.

Interested in joining the growing number of fund managers and investors who trust Sydecar to support their success? Book a demo with us today and explore how our platform can streamline your venture fund and SPV management:

Read More

Jun 27, 2024

Venture capital is an illiquid asset class. Investments in private companies, whether directly or indirectly (through funds), are locked up to some extent until the company goes public or gets acquired. Secondaries have always been and remain a strong mechanism for investors to achieve some level of liquidity before a traditional exit opportunity arises. However, as the exit market (and therefore liquidity) has dried up over the last few years, the volume of secondary transactions has grown dramatically. The robustness and types of secondary opportunities for investors have similarly expanded, yielding new and exciting opportunities for buyers and sellers.

What is a Secondary Transaction?

In the private markets, a secondary sale is any sale of ownership in a startup (typically common or preferred stock) where the seller is anyone other than the company itself. For instance, an investor may purchase Series Seed stock and then resell it to another investor several years down the line prior to the company going public or getting acquired (known as “exiting”).

A Brief History

Around the turn of the century, private markets grew exponentially with new capital and investors flooding in. Allocators started investing more, and as the market ebbed and flowed, investors needed liquidity. They turned to secondary sales for this. However, secondary sales had a stigma, leading to a scarcity of buyers, hesitancy from sellers, and tight regulations.

The 2008 financial crisis significantly impacted secondary markets. As liquidity dried up, LPs were forced to hold positions longer than expected, spurring a rise in secondary buyers and transactions. After a period of stability, the market saw a resurgence in 2020-2022, driven by high valuations and substantial committed capital, which led to large, late-stage investments in overvalued companies. Rising interest rates and declining market sentiment caused valuations to drop, closing the IPO market and hindering M&A activity. Consequently, a new wave of secondary vehicles, funds, and marketplaces has emerged to address these liquidity challenges.

Types of Secondary Transactions

Direct Secondaries

The most common form of secondaries occurs via "direct" sales, where the underlying asset is equity in a company. Given the restrictions on shareholders and transaction volume that large private companies are subject to, secondary transactions can be difficult for these companies to accommodate. To bypass these hurdles, investors can use SPVs to buy company equity and then trade shares of those SPVs. While this strategy can unlock liquidity opportunities, such transactions can also be complex and difficult to manage.

Fund Secondaries

Sometimes, shares of private companies are sold as part of a larger fund. When these fund positions are traded, they are called fund secondaries. Fund secondaries make up an entire ecosystem on their own. The exact nature and structure of a fund secondary can take on many forms. Three main mechanisms are the most popular:

LP-Led Secondaries

If an investor becomes a Limited Partner in a fund, they can also access the secondary market. As private funds often extend beyond their planned divestment date, investors might face liquidity issues. LPs looking for full or partial exits can sell their positions to other fund investors, outside investors, fund-of-funds, or specialized secondary funds. These dedicated secondary funds are becoming increasingly common, providing more options for LPs to achieve liquidity.

GP-Led Secondaries

When a fund is nearing the end of its intended lifecycle, GPs can introduce liquidity by selling the fund’s ownership of select companies in a secondary transaction. This strategy is similar to that of a direct secondary. Often, these positions are bought by private equity firms or secondary funds. This group also encompasses strip sales.

Continuation Vehicles

If a fund has reached the end of its intended lifecycle, but the portfolio is still not ready for liquidation, GPs can turn to continuation vehicles. These involve effectively rolling the current portfolio into a new fund or vehicle, which can include adding new LPs. Oftentimes, LPs of the original fund can use this to sell their stakes for liquidity, and secondary funds can utilize this technique to gain exposure to late-stage portfolios. Such vehicles have become very popular over the past year, and are expected to be a core focus of the secondary market’s trajectory in the near future.

Benefits of Secondaries

The primary function of a secondary transaction is to create liquidity for the initial purchaser. This is especially relevant in VC, where investments are typically “illiquid,” meaning that investors won’t receive a return for five, ten, or more years. Secondaries allow VCs to return funds to their LPs without having to wait for a portfolio company to exit.

Secondary sales can also allow VCs to recycle capital back into a fund. Instead of returning funds to LPs immediately, proceeds from exits or secondary sales are reinvested into additional companies. For LPs not needing early liquidity, this recycling can enhance long-term returns by deploying more capital into investments. It also improves fund metrics like IRR and total value paid in (TVPI), aiding in future fundraising efforts. This post by Sapphire Ventures provides an in-depth example of how recycling can impact fund return multiples.

If the VCs don’t have immediate plans for near-term liquidity, LPs can use secondaries for their portfolio positions. Much like a private ETF, secondary investors can buy later-lifecycle portfolios with more mature positions. Conversely, sellers can generate cash flow opportunities outside of the fund.

On the buyer side, secondary transactions rely on deal access. Secondaries provide a viable opportunity for newer investors, including angels and micro-fund managers, to buy ownership in companies they would not have been able to invest in directly. These are almost always later-stage companies, where there’s more demand for equity given that the companies are more established and have demonstrated success. Newer investors may see this as an appealing way to diversify their portfolio and participate in the value creation of a company soon before an IPO.

Because of these benefits and the increased interest in private markets as a whole, there has been a demonstrated increase in secondary activity over the past several years. Secondaries are particularly appealing to stakeholders such as family offices, high-net-worth individuals, and fund-of-funds that are newer to venture investing and therefore may not have access to primary investment opportunities.

If you're interested in tapping into these benefits and want a hassle-free way to invest, Sydecar can help. We make it easy to navigate secondary investments and boost your returns. Sydecar handles everything from automated banking and compliance to contracts and reporting for secondary transactions, so you can focus on deal-making. Visit our Secondary SPVs page to learn more and get started today.

Max Harris is the co-founder and CEO of Ticker Markets, a platform for private fund LP secondaries. Working primarily as a brokerage, Ticker aims to support liquidity solutions through the fund life cycle, connecting the secondary market to allow for lower mid-market individuals and family offices to access the growing pool of committed secondary capital. Before starting Ticker, Max worked in the aerospace and defence industry at Northrop Grumman, building out next generation space-based solar power technologies.

Read More

Jun 6, 2024

Emerging VCs are facing rising pressure to generate returns for their investors after several years of sub-par performance. As a result, demand has concentrated around certain deal types, specifically AI and pre-IPO companies. However, fundraising challenges have made it difficult for emerging managers to gather the substantial capital required for these opportunities.

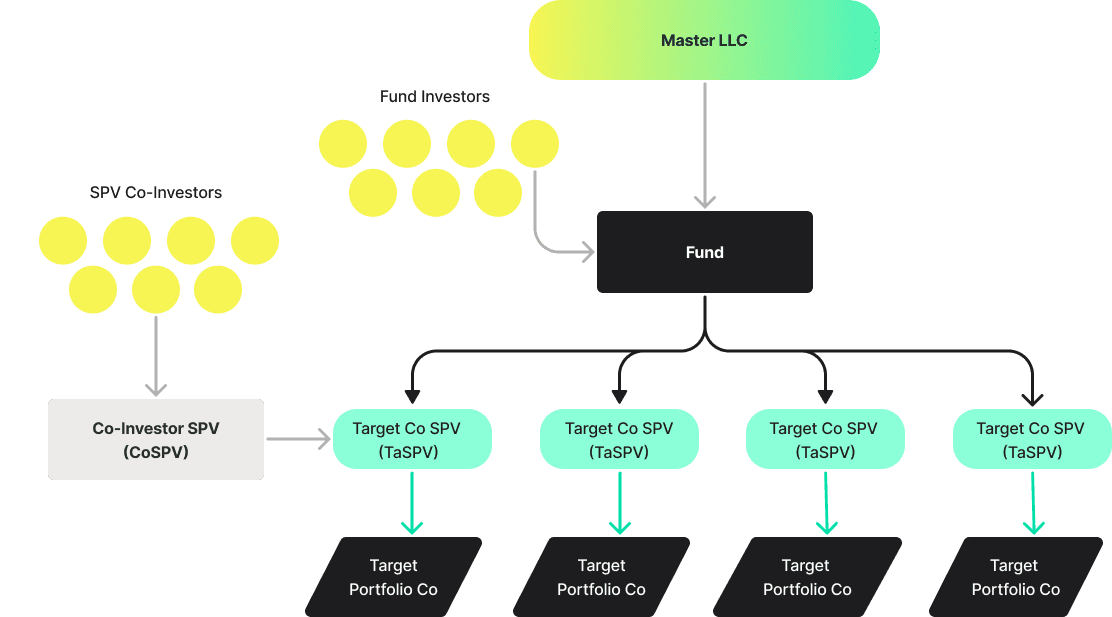

Late-stage companies, particularly AI startups like OpenAI and Anthropic, have attracted significant investment, but gaining direct cap table access to these companies is very difficult due to their high valuations and popularity. To overcome this, investors are turning to “pass-through” SPVs.

What is a Pass-Through SPV?

The term “pass-through SPV” typically refers to an SPV that is used by VCs to pool funds and invest in another pass-through entity (i.e. SPV), which has a direct allocation in a target company. These structures involve multiple pass-through entities that form the layers. Each SPV contributes funds up the chain until reaching the final investment.

Since these SPVs allow multiple investors to pool their resources, this approach makes it possible for investors to join high-value deals that would otherwise be out of reach.

Pass-through SPVs offer access to valuable investments and help emerging managers build stronger relationships with their investors by providing stakes in top companies. However, while this strategy opens up new opportunities, it also brings significant operational challenges, especially around transparency and tax reporting.

Why this is Happening

Access

Emerging managers struggle to meet the high minimum check sizes required for these coveted deals. By sourcing allocations through larger firms' SPVs, which might have $10-50M already secured, they can participate without needing to secure massive capital commitments or get a direct cap table allocation.

Investor Demand for Later Stage/More Liquid Deals

Investors are pushing for later-stage investments with higher liquidity potential due to recent record-low returns in venture capital.

Fund Size & Portfolio Construction

Pass-through SPVs allow emerging managers to participate in larger funding rounds without coming up against certain portfolio construction limitations. Standard operating agreements often limit the amount of capital from a fund that can be invested in a single portfolio company. However, SPVs allow managers to raise substantial capital through a sidecar vehicle, avoiding limitations that exist for their flagship fund.

Prominent Pass-Through SPV Deals

Recently, investors have used pass-through SPVs to secure stakes in high-demand AI startups like OpenAI and Anthropic. These structures pool funds from multiple parties, allowing smaller investors to participate in substantial deals they would otherwise miss. This trend has gained momentum as demand for AI startup shares has surged.

Thrive Capital's OpenAI SPV

Earlier this year, Thrive Capital led a significant purchase of existing OpenAI shares, estimated to be worth hundreds of millions of dollars. Thrive also created a smaller SPV, under $10 million, to give its investors additional exposure to the ChatGPT developer. Similarly, Soul Ventures and SparkLabs Global Ventures used SPVs to buy shares in OpenAI during a sale that valued the company at $86 billion. These SPVs provide a flexible way to increase holdings in coveted AI startups.

Menlo Ventures' Anthropic SPV

Menlo Ventures employed a pass-through SPV to take a prominent position in Anthropic. Menlo raised $750 million through an SPV, allowing it to invest heavily in the AI startup, which saw its valuation soar to $18.4 billion. This strategic move enabled Menlo to increase its stake without overextending its main venture fund. The SPV also included contributions from insiders and other key partners, maximizing the investment's impact.

Emerging Manager Perspective

Sydecar spoke directly with several emerging managers who identified the potential benefits and challenges when considering pass-through SPVs.

One major concern is the “look-through” rules. If an SPV invests in another SPV that qualifies for an exemption pursuant to Section 3(c)(1) of the Investment Company Act of 1940, the manager of the underlying SPV might have to count all the SPV’s investors towards the 100/250 investor limit.

For example, taking a $100K check that counts as 20 investors is less attractive than a $100K check that counts as one. This issue can manifest in two main ways:

Statutory Issues: According to 15 U.S. Code § 80a–3(c)(1)(A), when counting the beneficial owners of a 3(c)(1) fund, if the SPV owns 10% or more of the underlying fund, all entity investors in the SPV will count towards the 3(c)(1) limit. This is a clear rule but can be avoided by ensuring no entity investor in a 3(c)(1) fund owns more than 10% of the underlying fund.

Regulatory Issues: The SEC has stated through a series of no-action letters that if an SPV invests more than 40% of its assets into another 3(c)(1) or 3(c)(7) fund, there is a presumption that the SPV was formed for the purpose of investing in the underlying fund, and all the SPV investors would count towards the underlying fund's investor limit. This gray area requires careful consideration, although some precedents, like the Cornish & Carey letter, suggest that intent plays a role in the SEC’s determination. Specifically, funds should not be structured to circumvent regulatory provisions.

Additionally, an SPV that invests in another pass-through entity, rather than directly into a target company, is generally required to have a higher investor accreditation status than the standard accredited investor (i.e. qualified client or qualified purchaser).

Fiduciary duties also pose a challenge:

From a practical standpoint, managers must also consider the logistical complexities. Different SPVs might have varying advisors, structures, and requirements, complicating integration and management.

In an interview, one manager explained their cautious approach to pass-through SPVs:

Another manager noted that while they have not yet organized an SPV that accepted investment from another SPV, they have had discussions about potential structures. These include co-GP relationships where two GPs manage an SPV together, optimizing logistics and sharing economics.

Overall, while pass-through SPVs offer access to high-demand deals, emerging managers must navigate regulatory, fiduciary, and logistical challenges. Sydecar's platform helps mitigate some of these issues by providing compliance and administrative support, making the process more efficient and transparent.

Investor Perspective

Investors have mixed views on pass-through SPVs due to the potential for stacked fees. When fees from multiple layers of SPVs are combined, the overall cost eats into the investment amount, reducing the investor's exposure to the company and making these deals less attractive. Some managers address this by reducing fees or waiving them altogether, focusing instead on the value of access to high-demand opportunities. This strategy helps strengthen relationships with LPs, who may be more willing to invest in other vehicles where fees are charged.

SPVs often include preferential terms for a VC’s own backers. For instance, in the recent Anthropic round, fund LPs were expected to benefit from reduced or waived fees, making the investment more appealing to existing LPs.

Overall, while the prospect of stacked fees in pass-through SPVs can be a deterrent, transparent communication and strategic fee structures can enhance the attractiveness of these deals for LPs. By focusing on the value of access and maintaining strong LP relationships, managers can alleviate investor concerns and encourage them to continue investing.

Complexity of these Deals

Operational Complexities

Investing in pass-through SPVs can introduce operational challenges. Managers must ensure they raise enough money to cover fees for both the investing SPV and the underlying entity, which might require holding back some funds if not all fees are paid upfront. Transparency is crucial; managers must inform investors that their SPV is investing in another SPV, not directly in the target company. If the underlying SPV doesn't secure an investment in the company, the investors' funds might not be used as intended. This could result in returning the capital to investors, potentially reduced by fees, even though the deal didn't go through. Additionally, even if the investment doesn’t proceed, investors will receive a distribution, which may have tax consequences, and they will be issued a Schedule K-1 for their tax reporting.

Tax Complexities

Tax reporting for pass-through SPVs can be intricate, requiring waiting for underlying K-1s which can trigger filing extensions. As mentioned earlier, SPVs are typically formed as pass-through entities. This means that all income and deduction items pass through to each investor, retaining their tax characteristics. This information is communicated to each investor through a Schedule K-1. Each entity must first receive a K-1 from the underlying ‘layer’ (SPV) before it can file its tax return. The more layers there are, the longer the chain of K-1s. Depending on an SPV’s position within the chain, investors may need to wait significantly longer for their K-1s, requiring investors to extend the filing date of their own tax returns.

Importance of a Reliable Admin Partner

Given the complexities of managing pass-through SPVs, having a dependable admin partner like Sydecar is paramount. Sydecar ensures transparency, accurate tax reporting, and compliance, enabling emerging managers to navigate these pass-through investments effectively. Check out our Pass-Through SPVs page for more information about how we support these investments:

Sources:

Read More

May 30, 2024

A Vision for a New Investment Landscape

PariPassu, a members-only co-investment network launched by Pari Passu Venture Partners (PPVP), brings together a curated community of founders, operators, and tech enthusiasts to invest in leading Seed/Series A stage startups spanning eCommerce tech, SaaS, and consumer tech. Led by Insight-alum Julia Gudish Krieger, PPVP was built with founding partners and fellow operator-investors Kyle Widrick (founder of Win Brands Group) and Dylan Whitman (founder of Inveterate). PPVP aims to give industry insiders access to high-impact investments alongside top global venture capital firms and to be an engine for value-add that helps startups succeed. The early-stage venture firm has backed 22 companies to date, including Siena AI, Daasity, Function Health, and Mantle. PPVP’s co-investors include Sequoia, Upfront, 8VC, and Sierra Ventures.

The recent launch of their private investor app, PariPassu, amplifies PPVP’s mission, granting approved, accredited investors access to highly competitive investment opportunities on a deal-by-deal basis. The new app is designed intentionally to give members the ability to discover new opportunities, seamlessly track their investments, and support their portfolios all from the palm of their hand.

Breaking Barriers in VC

For many startups, the journey to success is marked with challenges that require more than just financial backing. Access to a powerful network of value-add operators—individuals who have hands-on experience in building and navigating companies—is imperative. However, such networks are not accessible to all.

Similarly, for operators and tech enthusiasts who wish to invest in startups, the barriers to entry in traditional venture capital are high. Typically, venture capital investments require a substantial financial commitment (often a $50K+ minimum), and gaining access to top-tier deal flow in competitive venture rounds requires deep-rooted relationships in the venture ecosystem. Many angel investors who prefer the flexibility of deal-by-deal investing find it difficult to identify high-quality, curated opportunities amidst a sea of mass-market crowdfunding sites and marketplaces.

A New Co-Investment Platform

Enter PariPassu, a private investor network and mobile app designed to democratize venture capital investment. PariPassu provides its members—accredited and approved industry operator-angels—with the opportunity to co-invest in category-defining startups alongside experienced venture capitalists, starting with as little as a $10K check.

Leveraging PPVP's extensive network and expertise in commerce enablement, SaaS, and consumer tech, PariPassu sources highly curated, often oversubscribed investment opportunities. The platform’s intuitive interface allows members to access deals in real time, invest with a lower entry point, engage with founders to provide support, and receive portfolio updates—all from the convenience of a mobile app. This approach enables individual founders and tech enthusiasts, who have traditionally been left out of venture capital investing, to join a supportive community. This community aids the next generation of startups, providing the support these companies often need to succeed.

Key Success Factors

Founder-Led Approach: The founder-led, founder-backed ethos of PPVP underpins the entire PariPassu platform, creating a sense of community and trust among members.

Curated Value-Add Network: PariPassu's community consists of some of the most high-profile leaders in commerce and tech, supercharging the value-add on cap tables. Many of the founders backed by PariPassu invest alongside the community in future rounds.

Investment Expertise: With a track record of creating over $200M of enterprise value and allocating hundreds of millions in capital, PPVP's team brings members access to highly competitive deals while still empowering angels with the flexibility to make their own investment decisions.

Accessibility: By lowering the barrier to entry to venture capital investment and using SPVs, PariPassu makes it possible for founders, operators, and other angels to participate in backing the leading technology companies of the future.

Streamlining the Investment Process

While SPVs offer significant flexibility to PariPassu’s network of investors, they can also be administratively burdensome. This is where Sydecar steps in. Sydecar handles the bulk of SPV back-end processes, from creating the investment entities and associated bank accounts, to handling K-1s for investors in the case of taxable events. This allows PariPassu to focus on meeting with founders and building their community of value-add investors. Since switching to Sydecar, PariPassu has closed 13 SPVs, benefitting from Sydecar’s streamlined product and quick, responsive customer support.

The Next Era of Venture Investing

PariPassu is on a mission to build the most powerful ecosystem of operator-investors and collectively back best-in-class companies. Their platform represents a paradigm shift in venture investing, democratizing access to the highest-caliber dealflow and empowering accredited investors to participate in the growth of innovative startups by co-investing with leading VCs. With its founder-led approach, curated network, and top-tier investment opportunities, PariPassu bolsters value-add on cap tables and supports the next generation of disruptive entrepreneurs.

If you're an accredited investor, download the ‘PariPassu’ app to receive access to PariPassu’s dealflow here.

Read More

May 1, 2024

We’ve been hard at work in Q1, launching several new features focused on improving the investment process for deal leads, fund managers, and investors. These updates address key areas of our business, including fund management, compliance, syndicate management, and financial operations. Our aim is to make your experience smoother, from easing ownership changes and automating tax document delivery to ensuring compliance and enhancing syndicate operations.

These product updates are in direct response to customer feedback, and they’re designed to streamline your workflow and support your investment goals.

Syndicate Contacts List

What it is:

The Syndicate Contacts List is designed to empower syndicate leads and angel groups by providing a centralized place to manage all of your investor contacts. This functionality allows syndicate leads to easily manage members, export contacts to a CSV, track investment activity, and streamline communications.

Why it's important:

These updates transform our platform into a powerful tool for syndicate management and communication, giving syndicate leads the ability to more effectively target, communicate, and close investors. Furthermore, the export functionality ensures syndicate leads can leverage their investor data flexibly, extending the utility of our platform beyond its native environment. This update signifies our commitment to evolving our platform to meet the sophisticated needs of our clients, enabling them to manage, analyze, and grow their investor networks more efficiently.

K-1 Delivery Update

What it is:

Sydecar delivered 100% of K-1s to SPV investors for the 2023 year (with the exception of vehicles that invested into a pass-through entity) ahead of the tax deadline for the second consecutive year. This success is largely due to our standardized approach to creating SPV and fund structures and their integration with our tax software.

Why it's important:

Our approach to delivering K-1 tax documents brings efficiency and accuracy to the forefront for both fund managers and investors. By automating the preparation process and directly integrating our systems with tax software, we've significantly cut down on manual work that fund managers need to complete and reduced the possibility of errors. This means we deliver K-1 documents well before the tax deadline, making tax season less stressful for fund managers and investors and eliminating the hassle of filing for extensions.

CTA Compliance

What it is:

In response to the Corporate Transparency Act (CTA) requirements, Sydecar has updated its SPV and Fund+ products to include a comprehensive compliance workflow. This involves collecting essential identification documents, such as driver’s licenses or passports, from investors. This move ensures a unified approach to document collection and compliance, streamlining the process for both new and existing investors.

Why it's important:

The CTA aims to combat financial crimes by enhancing transparency around company ownership, requiring detailed reporting of beneficial owners to the Financial Crimes Enforcement Network (FinCEN). By integrating CTA compliance with our KYC/EDD processes, Sydecar ensures that our clients are ahead of regulatory requirements without added hassle. This approach not only prepares our platform and its users for current compliance demands but also anticipates future regulations (including those that are state-specific), ensuring that your investment processes remain uninterrupted and secure. Our commitment to embedding these requirements into our platform reflects our dedication to your peace of mind and focus on building relationships and securing deals while we handle the complexities of compliance and data security.

For more information on the CTA, check out our blog post here.

Enhanced Due Diligence

What it is:

Enhanced Due Diligence (EDD) is a critical update to Sydecar’s compliance processes, focusing on in-depth verification and information gathering for investors with complex investment profiles. This update includes a comprehensive approach to collecting EDD information for deal leads and investors of SPVs. By integrating EDD requirements into the investor profile creation and updating processes, including a detailed EDD form for approval, Sydecar ensures rigorous adherence to regulatory requirements and enhances the security and integrity of investments.

Why it's important:

EDD is vital for maintaining compliance with global anti-money laundering (AML) regulations and safeguarding against financial crimes. By verifying the identities of investors with intricate investment portfolios, especially those from or banking in restricted countries, Sydecar provides a secure and compliant platform for venture investments. This process not only mitigates potential legal and financial risks but also reinforces trust among deal leads and their investors by demonstrating a commitment to thorough due diligence. Automating the collection and verification of EDD information streamlines compliance, reduces the administrative burden for deal leads, and ensures that all investments on the Sydecar platform meet the highest standards of regulatory compliance and financial security.

Now that these features are available, we're eager to see their impact on your operations. We believe that they will make a significant difference in your investment activities. Thank you to our customers for your continued support and trust in us.

Read More

Apr 25, 2024

“Should I charge management fees on my SPVs?” It’s a question we’ve heard time and again from syndicate leads in our community. As one can imagine, there’s not a one-size-fits-all answer. The fee structure you choose for your SPVs should be informed by your strategy and your LP base, among other factors. Read on to discover the pros, cons, and considerations of different fee structures.

Management Fees: A Foundation for Operational Stability

Management fees, typically ranging from 1.5% to 2.5%, are calculated on committed capital and collected annually or as a one-time, up-front fee upon closing. These fees cover operational costs such as salaries, office expenses, and professional services. Management fees provide a predictable revenue stream, which allows syndicate leads to cover the costs of handling essential tasks like deal sourcing and due diligence.

However, management fees can raise concerns if not aligned properly with investor interests. Overcharging on management fees could shift attention away from investment performance, causing a disconnect with your investors.

Table: Pros & Cons of Management Fees

Carried Interest: Aligning Interests Through Success

Carried interest (“carry”) represents a share of the profits from the SPV’s investments and is typically 20% (though it can range from 15% to 25%). Carry serves to align the syndicate lead’s interests with those of the investors by rewarding good performance. Since the majority of a syndicate lead’s compensation typically comes in the form of carry, it keeps them highly focused on generating returns for investors. This structure promotes a shared focus on maximizing returns, but, carry is contingent on the SPV's success, making it an unpredictable revenue stream–it may take years to see them, if they occur at all. We’ll discuss SPV profitability more in-depth shortly.

Other Fees

Beyond management and carry fees, syndicate leads might impose other charges for specific services, ranging from 0% to 5%, enhancing income while promoting strategic differentiation. These fees cover a variety of activities, such as deal sourcing, portfolio monitoring, or other professional services (e.g., tax, accounting, audit). When charging additional fees, a syndicate lead must be transparent with investors and justify these fees clearly. This avoids potential misalignments or conflicts of interest that could undermine trust or affect SPV performance.

Crafting Your Fee Model: A Strategic Approach

Choosing the appropriate fee model is more an art than a science, requiring a thoughtful analysis of several factors, including SPV size, investment strategy, and market positioning. Managers should aim to strike a balance that ensures operational viability while aligning closely with investor expectations and SPV performance goals.

Here are key considerations for setting your SPV's fee structure:

Operational Needs vs. Incentive Alignment: Assess the balance between covering essential operational costs and incentivizing performance.

Market Positioning: Understand your competitive edge and how it justifies your fee structure.

Investor Expectations: Engage with your investors to gauge their preferences and requirements for fee alignment.

Transparency and Flexibility: Ensure your fee model is clear, fair, and adaptable to changes in investment strategy or market conditions.

After determining what the best fee structure is for your situation, you may be thinking, “Okay…now when am I going to start making money?” Turning a profit from SPVs often involves a long-term commitment, requiring significant patience and planning. Syndicate leads must understand the timeline for returns and what supplementary income streams exist in order to manage their financial stability effectively.

A Decade to Profitability

It typically takes seven to ten years for a company to reach IPO stage from its founding. Considerable carry returns from seed-stage SPV investments can similarly take a decade to realize. GPs who run a fund can hedge their bets against this delay by charging management fees, providing them with a reliable source of income as they wait for potentially significant carry returns in the long term. Here’s a rough estimate of what GPs can expect to earn on a 2% management fee after other necessary expenses, organized by funding round & fund size:

However, for SPVs, not all GPs charge a management fee, as Cindy Bi highlighted in our recent Sydecar Session. Likewise, many syndicate leads choose to forego management fees due to investor pushback, relying instead on carried interest. This approach can lead to financial uncertainty due to the lack of a steady income stream. To boost their financial stability, syndicate leads look to other sources of income. Some of the top ways syndicate leads generate additional income include:

Consulting fees: Offering advisory services for a fee.

Early exits: Gaining interim income from early-stage company exits.

Secondary investments: Selling stakes in companies that have increased in value, before a liquidity event.

Non-venture investments: Earnings from public stocks or cryptocurrencies.

Part-time roles or other ventures: Many syndicate leads take on additional, part-time roles to supplement income. Some even pivot to working full-time for a VC fund for the guaranteed salary.

Newsletter: Operating a newsletter with a large audience to attract advertisers and generate ad revenue.

Membership programs: Launching a membership program, similar to Alex Pattis and Zach Ginsburg's "Deal Sheet" from Last Money In, offers a powerful way to generate revenue. Deal Sheet is a paid weekly newsletter that delivers top, actively investable startup investment opportunities directly to subscribers.

Running a syndicate involves balancing immediate financial needs with long-term gains. The typical syndicate lead experiences periods of low income, with occasional high returns. This leads to high turnover among syndicate leads, who may opt for more stable income sources.

With this in mind, deal leads must carefully plan their fee structures and consider their income strategies. In developing a fee model and profitability timelines, it is necessary to balance operational costs with the delayed returns common in venture capital. Syndicate leads should aim for a fee structure that supports operations, aligns with investor success, and remains adaptable to growth and market shifts.

As you get closer to realizing returns from seed-stage investments, your approach to fees may evolve, reflecting both your strategic vision and market realities. While the path to profitability is lengthy, the potential rewards can justify the investment for those prepared for the challenges.

Sydecar makes it easy for syndicate leads to adjust management and carry fees and provides LPs with complete visibility into deal fee structures. Request a demo below to learn more about how we streamline fee setup.

Read More

Mar 21, 2024

How can influencers raise capital for companies or funds, without running afoul of restrictions on “general solicitation”?

The 2012 bipartisan JOBS Act was supposed to empower funds and individuals to raise capital more openly: to publicly advertise their track record and what they’re selling, just like almost every other industry. However, as far as I know, the great majority of private capital raises for funds and companies are still not using general solicitation. Winter Mead, Founder & CEO of Coolwater, an accelerator for emerging fund managers, said: “Fewer than 5 of the 180 emerging managers we’ve worked with are raising via 506c, in order to get in front of more retail LPs, who are generally already following the GP, e.g., through the GP’s newsletter or community. At this point, all of them are currently planning to do 506c again for their next fund.”

Why has general solicitation not become more widely used among investors in alternative assets? There are four disadvantages to general solicitation.

General solicitation creates an obligation to verify that investors are accredited. William Stringer, Founder, Chisos, said, “The benefits of 506(c) were clear when we were raising smaller checks into a small fund from individual accredited investors. However, because of the additional information burden we almost lost a few larger, more sophisticated investors that did not want to be bothered for a relatively small investment.” You can typically outsource this for as little as $60 to companies such as VerifyInvestor.com or EarlyIQ. Or, Yoni Tuchman, Fund Formation Partner at DLA Piper, said, “Include a form letter in your sub docs that the LP can have their lawyer or accountant sign.”

Time efficiency. General solicitation requires engaging with many potential investors, most of whom are just tire-kickers, not check-writers. Founder Pete Cashmore observed, “Smaller (or non-professional) investors may have unreasonable expectations of returns, which could result in conflict in the case of failure.”

Signaling. When you’re raising capital for a fund (or private company) you’re fundamentally selling a luxury good, which is seen as more valuable because it’s scarce. General solicitation damages that perception.

Inherent conservatism of LPs. Brian Laung Aoaeh, Founder & Managing General Partner, REFASHIOND Ventures, said, “We chose not to do general solicitation for our institutional fund after doing a 506(c) rolling fund because we got the sense that most institutional LPs are not yet very comfortable with the rules. Explaining that a certification from an attorney or accountant would be sufficient did not appear to be sufficiently persuasive.”

With that said, what is the best way to market your capital-raise to potential investors, while staying compliant? This is particularly relevant for influencers who have an audience, as many emerging fund managers do.

David Teten, Venture Partner at Coolwater, interviewed Sydecar’s CEO, Nik Talreja, to provide some guidance based on his deep expertise in this area.

David Teten: Hi Nik. Can you introduce yourself and Sydecar?

Nik Talreja: I’m the Co-Founder and CEO of Sydecar, a fintech company on a mission to bring more transparency, efficiency, and liquidity to private markets. The idea for Sydecar unfolded in my mind during my decade-long career as an attorney working in capital markets and then working directly with startups and VCs on financing events.

I practiced securities and transactional law at Weil, Gotshal & Manges and Cooley before branching out and starting my own law firm, where I supported early stage startups and investors. The experience of working with stakeholders on all sides of these transactions – companies, VCs, and their LPs – made me realize how fractured the ecosystem is. Every person is kind of speaking their own language and it makes it difficult to communicate and ultimately to transact. Every VC has their own fund model which has to be supported by a service-driven fund administrator. To add to that, there are many gatekeepers – law firms, accountants, tax advisors – who are basically charging rent for customization and tradition.

It occurred to me that there could be a better way of approaching fund administration, where product mediates the back and forth between stakeholders, and where basic structures are standardized. It was also important to me that the fund administration model isn’t connected to any marketplace that dictates how you should operate. While pursuing my legal career, I began investing behind some of my clients and worked hard to build a small LP base. I didn’t want to bring hard-earned relationships to a marketplace where they’d be exposed to other fund managers – and I figured other new managers would feel the same. Sydecar was born as a result.

David Teten: Does Sydecar currently support fundraising via general solicitation?

Nik Talreja: Sydecar's standard SPVs and Funds are governed by 506(b) meaning that general solicitation isn’t permitted; managers can only raise from people they have an existing relationship with. We can support select 506(c) deals and are happy to discuss with customers on a case-by-case basis.

We’ve thought about more widely supporting 506(c) funds in the future, especially if it’s something that our customers want. But to start with, we saw the most demand for raising under 506(b) and so chose to focus on that. It’s been interesting to see how some of our customers leverage communities they have built to help them fundraise even without the ability to generally solicit. We’ve seen a lot of creativity.

David Teten: Can you share more about that? How can someone who has built a following online successfully raise from their community under 506(b) without general solicitation?

Nik Talreja: Sure thing. To start with, it’s important to really understand where the line is drawn between 506(b) and 506(c). Under 506(b), you can raise capital from any accredited investor so long as you are not using general solicitation. Practically speaking, this means that one cannot raise money for an investment vehicle (SPV or fund) from individuals that they don’t have a “substantial preexisting relationship” with. This includes marketing the investment opportunity on social media, websites, television, radio, or any other public channel. As a result, individuals who want to avoid 506(c) general solicitation and have a large Twitter following or newsletter can’t directly ask their audience to invest into a specific deal or fund that they are raising for.

Rather than marketing a specific deal or fund, people with online audiences can market themselves and their expertise to stay compliant under 506(b). Using marketing and PR channels to highlight your general success as an investor and then giving people a way to get in touch can be an effective mechanism to convert an audience to an investor base. The big takeaway here is that you have to establish a “substantial preexisting relationship” with an investor before inviting them to participate in a specific deal.

In 2015, the SEC issued a “No Action” letter to Citizen VC relating to the topic of general solicitation and the definition of a “substantial existing relationship”: “ a "substantive" relationship is one in which the issuer (or a person acting on its behalf) has sufficient information to evaluate, and does, in fact, evaluate, a prospective offeree's financial circumstances and sophistication, in determining his or her status as an accredited or sophisticated investor.” Read the full letter here.

The bottom line is that you cannot market the opportunity directly to people you don’t know without triggering 506(c). In the eyes of the SEC, you do not know your audience. However, if a member of your online audience fills out a form sharing information about their background and you subsequently schedule a 1:1 phone call with the investor, that generally meets the standard for a substantial existing relationship.

So the key points are:

Do not market specific opportunities broadly.

Do not market an opportunity directly until you’ve established a “substantial preexisting relationship” with the investor.

Filling out a form and jumping on a call constitutes a “substantial preexisting relationship” in the eyes of the SEC.

While it may take more time, it’s not impossible to establish a relationship with someone you met through social media or a newsletter sign-up before sharing deal flow with them. Of course, when raising from a large audience, managers should expect a low conversion as compared to raising from a traditional warm introduction. Having a smooth process in place to establish relationships and share information is key.

A final note on all of this is that whether it’s 506(b) or 506(c), the investors involved need to be accredited. For 506(b), the investor can check a box to confirm they’re accredited once a “substantial relationship” has been established. For 506(c), the investor will need to provide proof of accreditation through sharing account statements or providing a signed letter from an accountant or lawyer.

David Teten: If the potential investor participates in a webinar or an in-person gated event, does that suffice?

Nik Talreja: A "pre-existing substantive relationship" exists when there has been some interaction between the two parties, whereby the investor communicates sufficient information to the issuer (in this case, the fund manager) for the issuer to determine their financial circumstances and sophistication. If the investor is just an attendee of a webinar hosted by the manager, and the two parties don’t directly interact, then they have not established a pre-existing relationship.

If participation in the webinar (or any other virtual or in-person event) involves the investor disclosing their financial status and investment experience to the manager, and if it is reasonable for the manager to believe the investor, then yes, this would be permitted.

David Teten: Do you have any examples of folks who have done this successfully?

Nik Talreja: A good example is Nik Milanovic, founder and GP of The Fintech Fund. Nik launched his newsletter, This Week in Fintech, in 2019 as a way to share his thoughts about the evolving fintech landscape with friends, family, and select coworkers. The newsletter grew and people started asking Nik how they could invest into the companies he wrote about. Before too long, Nik had a full-blown syndicate. Because his newsletter subscribers were initially all people he knew personally, they were fair game to raise money from under 506(b). As the newsletter and syndicate grew, Nik built out a process for converting a subset of newsletter subscribers (those who were accredited and had a genuine interest in his deal flow) into syndicate investors.

Once an investor is accepted into his syndicate, Nik adds them to a private Slack channel where they can see new deals, discuss diligence, and ultimately decide if they want to invest. The investor relationships and track record of success that Nik built through his syndicate investing ultimately allowed him to raise a $10M Fund 1 in 2022 (also under 506(b)).

David Teten: Can you expand on the process that Nik built out for converting a subset of newsletter subscribers into syndicate investors?

Nik Talreja: The benefit of Nik having run a newsletter in which he shared his perspective on emerging companies with his reader base was that they started to get comfortable with – and then interested in – how he thought about these companies. He started to receive inbound demand from readers asking how they could invest in early-stage fintech companies and grow their dealflow. That made it pretty easy to consolidate them into a group and build the syndicate off an active, dedicated early group.

David Teten: What are examples of compliant language fund managers have used to alert investors to the investment opportunity in funds?

Nik Talreja: Keeping your language general is key to staying compliant under 506(b). You can talk about investing. You can even talk about the opportunity for people to invest alongside you. You cannot invite people to invest in a specific opportunity.

Here are some examples of language that can be used to alert investors of the opportunity without triggering 506(c):

“We’re always looking for new investors to collaborate with! If interested in participating as an LP or co-investor, please fill out this form or reach out directly.”

“Thinking about your first investment? We’d love to learn more about your interests and see if there’s room to work together.”

“We’re holding a webinar for accredited investors only to learn more about our fund and the companies we think are highest potential. RSVP here.” [RSVP form includes a self-attestation of accredited investor status.]

Here are some public examples: The Council Angels, @TheRideShareGuy, @JeanineSuah

David Teten: What are the ‘red lines’ that people with online audiences should avoid hitting which would trigger 506(c)?

Nik Talreja: Here are some examples of language that would trigger 506(c):

“I’m raising a $10M fund! Reach out if you want to invest.”

“We are running an SPV for SpaceX. If you want to invest please reach out.”

You’ll notice that the language for 506(b) from earlier is general and pushes towards gathering more information from the investor, while the language that triggers 506(c) is specific.

Being general with your language and driving potential inventors to provide more information is key in order to satisfy the “substantial preexisting relationship” rule that sits between 506(b) and 506(c).

If you do have a “substantial preexisting relationship” with an investor, it’s 506(b).

If you do not have a “substantial preexisting relationship” with an investor, it’s 506(c).

David Teten: Given the current market sentiment of institutional LPs being more cautious about deploying into VC, do you expect to see an uptick in 506c offerings in the coming months?

Nik Talreja: No, I expect the contrary. I think we’ll see a decrease in the number of deal and fund managers overall, and the people who continue deploying capital will be those who have quality relationships with LPs and access to quality investment opportunities. These repeat managers tend to rely on 506(b) given their strong relationships with LPs and meaningful track records. The quality of your relationships has become increasingly important through the down market – and I expect this will continue to be the case.

For an aspiring manager to be successful in this environment, they have to spend more time deepening trust with LPs, sharing their decision-making process, and explaining the quality of their deal flow. 506(c) type offerings assume that low-touch LP relationships are sufficient, which is at odds with what I expect in the current environment.

David Teten: Are there any differences in the types of investors that invest into 506b offerings, versus 506c?

Nik Talreja: 506(c) offerings typically involve more participation from "retail" investors, or people who invest non-professionally. The term has been used to describe investors who aren’t well versed on an asset class, don’t have institutional relationships, and don’t have access to invite-only deals.

In this sense, 506(c) offerings cast a wide net -- there is no need for a deal sponsor to have a relationship with an LP, or vice versa -- and so a sponsor can post an offering on social media where anyone can view details and get involved, including retail investors.

David Teten: What are the consequences of unintentionally using general solicitation and failing to switch to a 506c offering?

Nik Talreja: It's always best to consult your attorney to ensure you get a full download on your particular situation, so consider the following with a grain of salt. If you generally solicit an offering that is registered under 506(b), you may lose your securities exemption under 506(b) and the result could be that:

Your securities are considered "unregistered" and investors may have a right to cancel or recall their investment.

You could be penalized and have to pay fees to regulatory authorities.

How large is this risk? Tough to say, but there are many cautionary enforcement actions. Bottom line: it's always best to consult counsel if you are thinking about raising for an SPV or fund and have questions about how you are or are not allowed to source investors.

David Teten: Is it worth avoiding 506(c)?

Nik Talreja: Ultimately, this is a matter of personal preference. 506(c) is doable if you’re willing to jump through the hoops of verifying each investor’s accreditation. It’s another step in the process, but it shouldn’t make or break an investor’s decision.

That being said, taking on LPs that you don’t personally know creates new risk – just like doing business with strangers. Whether you run a 506(b) or 506(c) process, it’s important to understand who you’re working with and connect with their LP base as much as possible in order to build a long term relationship.

Any manager who is considering raising under 506(c) should consult their legal counsel and / or fund administrator. While Sydecar doesn’t generally offer a 506(c) fund structure, it’s something that we’re actively exploring via a pilot program. To learn more, request a demo with a member of the Sydecar team today.

The information provided in this article is for informational purposes only and should not be construed as legal advice. The content is intended to offer general guidance and insights on the topic discussed. It is not a substitute for professional legal advice tailored to your specific situation. Always consult with a qualified attorney or legal expert for advice pertaining to your individual circumstances

Further reading:

Fundraising hacks for VC and private equity funds (includes lists of LPs interested in emerging managers)

15 Steps to Fundraising for Your New Venture Capital or Private Equity Fund

5 Innovative Fundraising Methods for Emerging Venture Capital and Private Equity Funds

Should you give an anchor investor a stake in your fund’s management company?

Read More

Feb 29, 2024

Navigating the complexities of tax season is a constant challenge for venture capitalists. In this comprehensive guide, we dive into important tax considerations for VCs and share how Sydecar can help you have a stress-free tax season.

VC Tax 101

The majority of VC investment vehicles (i.e. venture funds and SPVs) are pass-through vehicles, meaning that the responsibility to report gains and losses for tax purposes is passed through to the underlying investors. This setup avoids the double taxation typically seen in corporations, where income is taxed at both the corporate and the shareholder levels. The most common forms of pass-through entities used in venture capital include Limited Partnerships (LPs) and Limited Liability Companies (LLCs). All SPVs and funds formed on Sydecar are formed as LLCs.

Key Tax Components for Venture Funds

Carried interest, often a significant portion of your earnings as a fund manager, is taxed as a capital gain. A fund’s governing agreement (LPA or LLCA) outlines how carried interest is allocated to GPs and other investment team members, who are then liable for taxes on this income.