Celebrating $1 Billion in AUA: A Milestone for Market Standardization and Transparent Investing

Celebrating $1 Billion in AUA: A Milestone for Market Standardization and Transparent Investing

Jul 2, 2024

Gavin Freeman

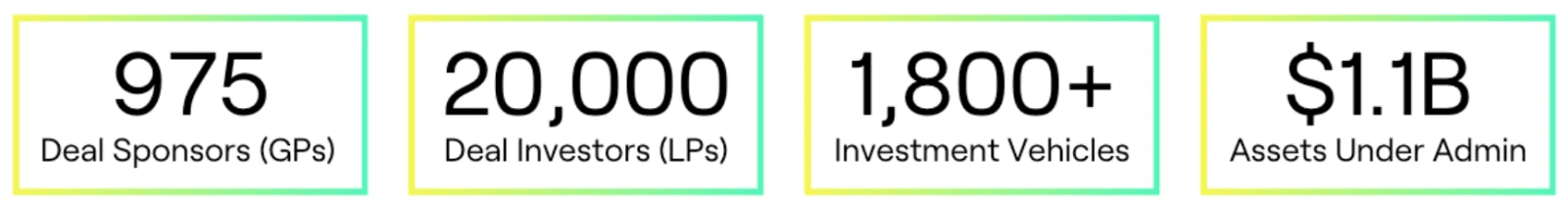

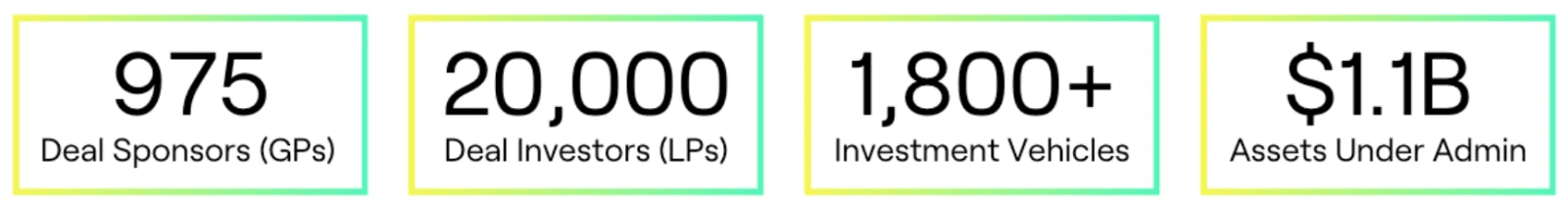

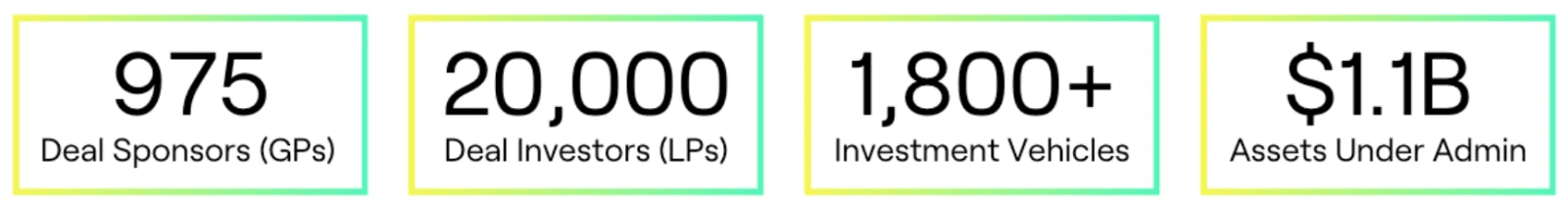

We're excited to share that Sydecar has surpassed $1 billion in assets under administration (AUA). Here's a snapshot of how we’re doing currently:

As we celebrate surpassing this mark, we're not just signaling a financial milestone; we're showcasing a shift towards a more standardized, transparent, and efficient approach to private investing. This achievement underscores our platform's credibility and the trust the market places in our mission to streamline venture fund and SPV management.

Reaching $1 billion in administering assets reflects the growing confidence that fund managers and investors place in Sydecar. It's a testament to our platform's ability to manage deal execution seamlessly. Our journey from reaching $350 million in AUA just two years ago to now administering over $1 billion illustrates our capability to scale and adapt to the evolving needs of the venture capital ecosystem.

Embracing Standardization in Private Investing

This milestone is significant not just for Sydecar but for the entire venture ecosystem. It signals a shift towards embracing a standardized approach to structuring and managing investment vehicles. Standardization brings numerous benefits, including reduced complexities, lower costs, and improved accessibility for new entrants in the venture capital space. By pioneering a product-driven approach, Sydecar has established an industry standard to simplify the investment process, making it more transparent and accessible.

Advancing Our Mission for a More Transparent and Efficient Market

Achieving $1 billion in assets under administration brings us closer to realizing our mission of enhancing transparency, efficiency, and liquidity in private markets. This milestone demonstrates our capability to provide clear and accessible processes, streamline complex operations, and facilitate quicker transactions, increasing market liquidity.

A Look Back: The Road to $1 Billion

Sydecar was born out of a necessity to solve the inefficiencies and high barriers to entry in private investing. Our founders experienced first-hand the challenges of setting up and managing investment vehicles. This understanding drove our commitment to creating a platform that not only meets the compliance and operational needs of today's investors but also anticipates the demands of tomorrow's market dynamics.

Our SPV product was just the beginning. Today, Sydecar supports a wide array of investment activities with tools that ensure compliance, streamline operations, and enhance investor communication. These tools have been crucial in achieving the milestone we celebrate today.

Looking Forward

As we continue to grow, our focus remains on expanding our platform to support the next wave of innovations in venture investing. The introduction of new products designed to remove regulatory barriers and enhance capital formation is on the horizon. We are excited about the future and committed to supporting our clients in unlocking more opportunities in private markets.

We are incredibly grateful to our clients, partners, and the entire Sydecar team for being part of this journey. Here's to continuing our mission of transforming private market investing together.

Interested in joining the growing number of fund managers and investors who trust Sydecar to support their success? Book a demo with us today and explore how our platform can streamline your venture fund and SPV management:

We're excited to share that Sydecar has surpassed $1 billion in assets under administration (AUA). Here's a snapshot of how we’re doing currently:

As we celebrate surpassing this mark, we're not just signaling a financial milestone; we're showcasing a shift towards a more standardized, transparent, and efficient approach to private investing. This achievement underscores our platform's credibility and the trust the market places in our mission to streamline venture fund and SPV management.

Reaching $1 billion in administering assets reflects the growing confidence that fund managers and investors place in Sydecar. It's a testament to our platform's ability to manage deal execution seamlessly. Our journey from reaching $350 million in AUA just two years ago to now administering over $1 billion illustrates our capability to scale and adapt to the evolving needs of the venture capital ecosystem.

Embracing Standardization in Private Investing

This milestone is significant not just for Sydecar but for the entire venture ecosystem. It signals a shift towards embracing a standardized approach to structuring and managing investment vehicles. Standardization brings numerous benefits, including reduced complexities, lower costs, and improved accessibility for new entrants in the venture capital space. By pioneering a product-driven approach, Sydecar has established an industry standard to simplify the investment process, making it more transparent and accessible.

Advancing Our Mission for a More Transparent and Efficient Market

Achieving $1 billion in assets under administration brings us closer to realizing our mission of enhancing transparency, efficiency, and liquidity in private markets. This milestone demonstrates our capability to provide clear and accessible processes, streamline complex operations, and facilitate quicker transactions, increasing market liquidity.

A Look Back: The Road to $1 Billion

Sydecar was born out of a necessity to solve the inefficiencies and high barriers to entry in private investing. Our founders experienced first-hand the challenges of setting up and managing investment vehicles. This understanding drove our commitment to creating a platform that not only meets the compliance and operational needs of today's investors but also anticipates the demands of tomorrow's market dynamics.

Our SPV product was just the beginning. Today, Sydecar supports a wide array of investment activities with tools that ensure compliance, streamline operations, and enhance investor communication. These tools have been crucial in achieving the milestone we celebrate today.

Looking Forward

As we continue to grow, our focus remains on expanding our platform to support the next wave of innovations in venture investing. The introduction of new products designed to remove regulatory barriers and enhance capital formation is on the horizon. We are excited about the future and committed to supporting our clients in unlocking more opportunities in private markets.

We are incredibly grateful to our clients, partners, and the entire Sydecar team for being part of this journey. Here's to continuing our mission of transforming private market investing together.

Interested in joining the growing number of fund managers and investors who trust Sydecar to support their success? Book a demo with us today and explore how our platform can streamline your venture fund and SPV management:

We're excited to share that Sydecar has surpassed $1 billion in assets under administration (AUA). Here's a snapshot of how we’re doing currently:

As we celebrate surpassing this mark, we're not just signaling a financial milestone; we're showcasing a shift towards a more standardized, transparent, and efficient approach to private investing. This achievement underscores our platform's credibility and the trust the market places in our mission to streamline venture fund and SPV management.

Reaching $1 billion in administering assets reflects the growing confidence that fund managers and investors place in Sydecar. It's a testament to our platform's ability to manage deal execution seamlessly. Our journey from reaching $350 million in AUA just two years ago to now administering over $1 billion illustrates our capability to scale and adapt to the evolving needs of the venture capital ecosystem.

Embracing Standardization in Private Investing

This milestone is significant not just for Sydecar but for the entire venture ecosystem. It signals a shift towards embracing a standardized approach to structuring and managing investment vehicles. Standardization brings numerous benefits, including reduced complexities, lower costs, and improved accessibility for new entrants in the venture capital space. By pioneering a product-driven approach, Sydecar has established an industry standard to simplify the investment process, making it more transparent and accessible.

Advancing Our Mission for a More Transparent and Efficient Market

Achieving $1 billion in assets under administration brings us closer to realizing our mission of enhancing transparency, efficiency, and liquidity in private markets. This milestone demonstrates our capability to provide clear and accessible processes, streamline complex operations, and facilitate quicker transactions, increasing market liquidity.

A Look Back: The Road to $1 Billion

Sydecar was born out of a necessity to solve the inefficiencies and high barriers to entry in private investing. Our founders experienced first-hand the challenges of setting up and managing investment vehicles. This understanding drove our commitment to creating a platform that not only meets the compliance and operational needs of today's investors but also anticipates the demands of tomorrow's market dynamics.

Our SPV product was just the beginning. Today, Sydecar supports a wide array of investment activities with tools that ensure compliance, streamline operations, and enhance investor communication. These tools have been crucial in achieving the milestone we celebrate today.

Looking Forward

As we continue to grow, our focus remains on expanding our platform to support the next wave of innovations in venture investing. The introduction of new products designed to remove regulatory barriers and enhance capital formation is on the horizon. We are excited about the future and committed to supporting our clients in unlocking more opportunities in private markets.

We are incredibly grateful to our clients, partners, and the entire Sydecar team for being part of this journey. Here's to continuing our mission of transforming private market investing together.

Interested in joining the growing number of fund managers and investors who trust Sydecar to support their success? Book a demo with us today and explore how our platform can streamline your venture fund and SPV management:

Disclaimer: This content is made available for general information purposes only, and your access or use of the content does not create an attorney-client relationship between you or your organization and Sydecar, Inc. (“Company”). By accessing this content, you agree that the information provided does not constitute legal or other professional advice, including but not limited to: investment advice, tax advice, accounting advice, legal advice or legal services of any kind. This content is not a substitute for obtaining legal advice from a qualified attorney licensed in your jurisdiction and you should not act or refrain from acting based on this content. This content may be changed without notice. It is not guaranteed to be complete, correct or up to date, and it may not reflect the most current legal developments. Prior results do not guarantee a similar outcome. Please see here for our full Terms of Service.